The Toqio Marketplace: A thriving fintech ecosystem

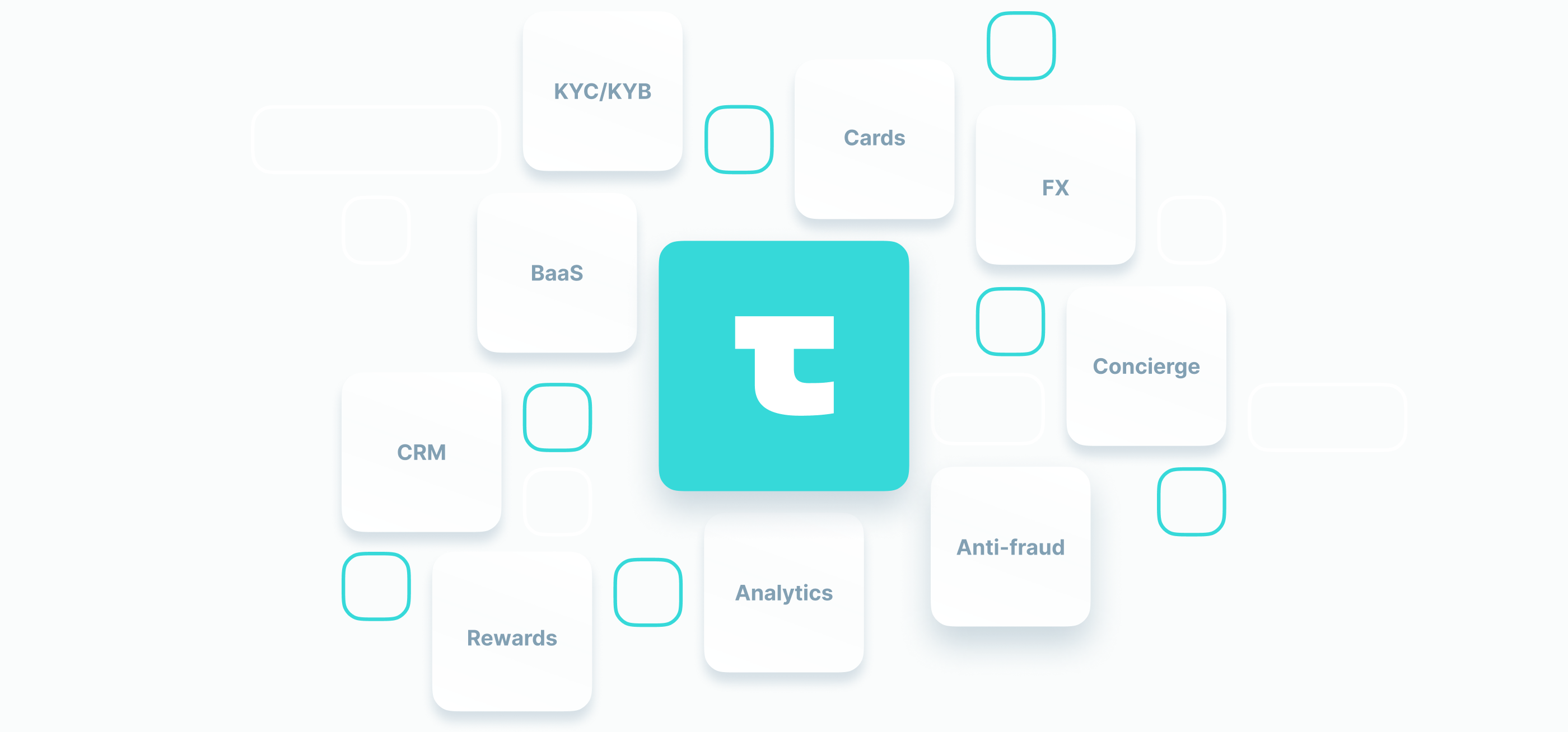

Toqio is in the midst of growing the Toqio Marketplace, a robust ecosystem of banking and financial service functions. It is designed to integrate a wide selection of digital and operational solutions for a quick market launch through a low-code environment.

Currently in a rapidly expanding growth phase, the Marketplace offers a selection of BaaS providers as well as product partners from which clients can select the best fits for their particular solutions.

Use cases are key

“Today we offer a number of BaaS providers our clients can choose from, according to their needs and existing relationships”, says Christian Ball, Toqio’s Head of Partnerships, “as well as partners that offer very specific functions related to financial services. The concept will grow according to the use cases of companies that want to build something unique with Toqio. That can be creating a solution that offers payments and FX, lending management, internal expense tracking, treasury and payment operations – whatever. We envision building towards a Marketplace replete with modules from which our clients will be able to select the features that best suit their needs according to the requirements of their businesses and their users.”

A complete financial ecosystem at your fingertips

Using the Toqio Marketplace, clients can go beyond Toqio’s already impressive development and design environment to partner with proven industry leaders to launch highly customized solutions.

“We believe that pre-integrating capabilities into our offering is one of our major growth differentiators,” says Michael Galvin, Toqio’s Co-Founder and CCO. “We give our clients the ability to build value by using a host of predefined tools and relationships. We’ve already done all the homework in terms of compliance, security, and technology, and our partners are among the best in the sector. Our Marketplace shortens the time to market dramatically.”

Toqio has rolled out a surprisingly flexible system where any Toqio client that has built a custom module can make it available for use by others, thereby enjoying a new revenue stream in the process. As the Marketplace matures, partners will continue to release new modules and products, giving clients instant access to the latest and most innovative fintech applications as soon as they are released.

Building a product feature by feature

The Toqio Marketplace provides organizations with a wide array of advanced, in-demand capabilities, including a selection of BaaS providers and financial service functions.

Currently, clients can select from numerous fully compliant market leaders, including Currencycloud, EML, Modulr, Railsr, and ClearBank, also a fully regulated clearing bank. The provider chosen often depends on either clients’ preexisting relationships or the feature set required for their particular builds, as each provider offers value-added services apart from simple BaaS. Currencycloud, for example, has integrated a number of exclusive and attractive FX functions through the Toqio platform. Railsr brings credit card as a service (CCaaS) to the table. Modulr, on the other hand, is known for offering extensive cross-border coverage throughout the entire EU. The list goes on.

Further, the burgeoning Marketplace also offers exclusive features offered by partners focussed exclusively on financial services or ancillary functions that enhance a build and make it a truly unique solution. If clients require an account servicing payment service provider (ASPSP), they can depend on acclaimed firm Tell.Money for the service directly through Toqio. Complete KYC and KYB anti-fraud features are provided by TruNarrative, giving clients the comprehensive ability to verify, transact with, and monitor their customers, clients, and suppliers. SME is the go-to partner for anything related to invoice financing and building deeper, more profitable relationships with users. Communication between Toqio clients and their users is handled by Intercom, which offers real-time chat and support. Again, the list goes on and is expected to grow longer as existing partners develop new modules and new partners join the Marketplace.

Five benefits that the Toqio Marketplace delivers

1. Swift speed to market

With Toqio Marketplace, clients go from identifying the modules they want to integrate to going live to market within a matter of weeks or even days.

2. Markedly lower integration costs

Compared to developing a fintech solution in house or partnering with third-party financial institutions, Toqio and the Toqio Marketplace are far more cost-effective in terms of both up-front and ongoing maintenance costs. The Marketplace enables substantial cost reduction while positioning a company to access and unleash the latest fintech products.

3. A comprehensive ecosystem

Companies decide what they need and the fintech solution they require. The Toqio Marketplace either has it or provides everything required to make it a reality and launch rapidly.

4. New revenue stream opportunities to exploit

Many of the ready-made solutions on Toqio Marketplace are designed specifically to respond to new market needs and maximize revenue potential. Toqio clients can also create their own modules and release them for third-party use as an additional revenue source.

5. Lower financial and delivery risk

The initial vision for a product and what it looks like before launch tends to vary significantly, with compromises typically made along the way because of time and cost issues. This can put considerable strain on an organization’s business strategy. With Toqio, the speed to market and much lower costs involved mean that these eventualities are much less likely to materialize, representing a significant reduction in financial and delivery risk. As a result, organizations have a much higher degree of freedom and flexibility when it comes to product updates and new product launches.