From Idea to Growth in Embedded Finance.

We empower corporates and financial institutions to build and scale tailored financial products faster than anyone else.

Our expert team shapes powerful embedded finance propositions and brings them to market with unmatched speed. From strategy to scale, the Toqio Platform turns vision into growth.

Best Embedded Finance System

2024

Inducted into the Visa Innovation Program Europe

2024

Inducted into the AWS Global Accelerator program

2023

Finance is no longer a product,

it’s a growth strategy driven by alliances.

Companies can easily embed financial services into their platforms,

solving real SME pain points and turning finance into a revenue-generating, retention-driving value layer.

The new financial ecosystem runs through corporates.

We pioneered the Agent 2.0 model, a next-generation approach that transforms corporates into high-performance distributors of financial services. By combining their reach with our platform and expertise, corporates deliver banking, lending, and payments solutions directly to customers, unlocking new revenue streams and deeper relationships.

This structural shift makes corporates the primary channel connecting banks and fintechs to end customers, creating win-win-win value for corporates, financial institutions, and SMEs.

We're trusted by leading brands.

See who’s already using our platform to drive innovation and impact.

-2.png?width=250&height=125&name=Untitled%20design%20(3)-2.png)

Build once, deploy many, scale quickly.

Toqio combines a robust no-code/low-code platform with a specialized partner marketplace, and enables the scalable and cost-effective deployment of financial solutions. That means you can build once and deploy to as many verticals as you need to, within just a few weeks.

STRATEGY

Blueprint for Growth

We start by working with you to design your strategy and product vision. Together we define the right product to fuel your growth, identify the key levers for success, and set the foundation for everything that comes next.

DESIGN

The Toqio Design Studio

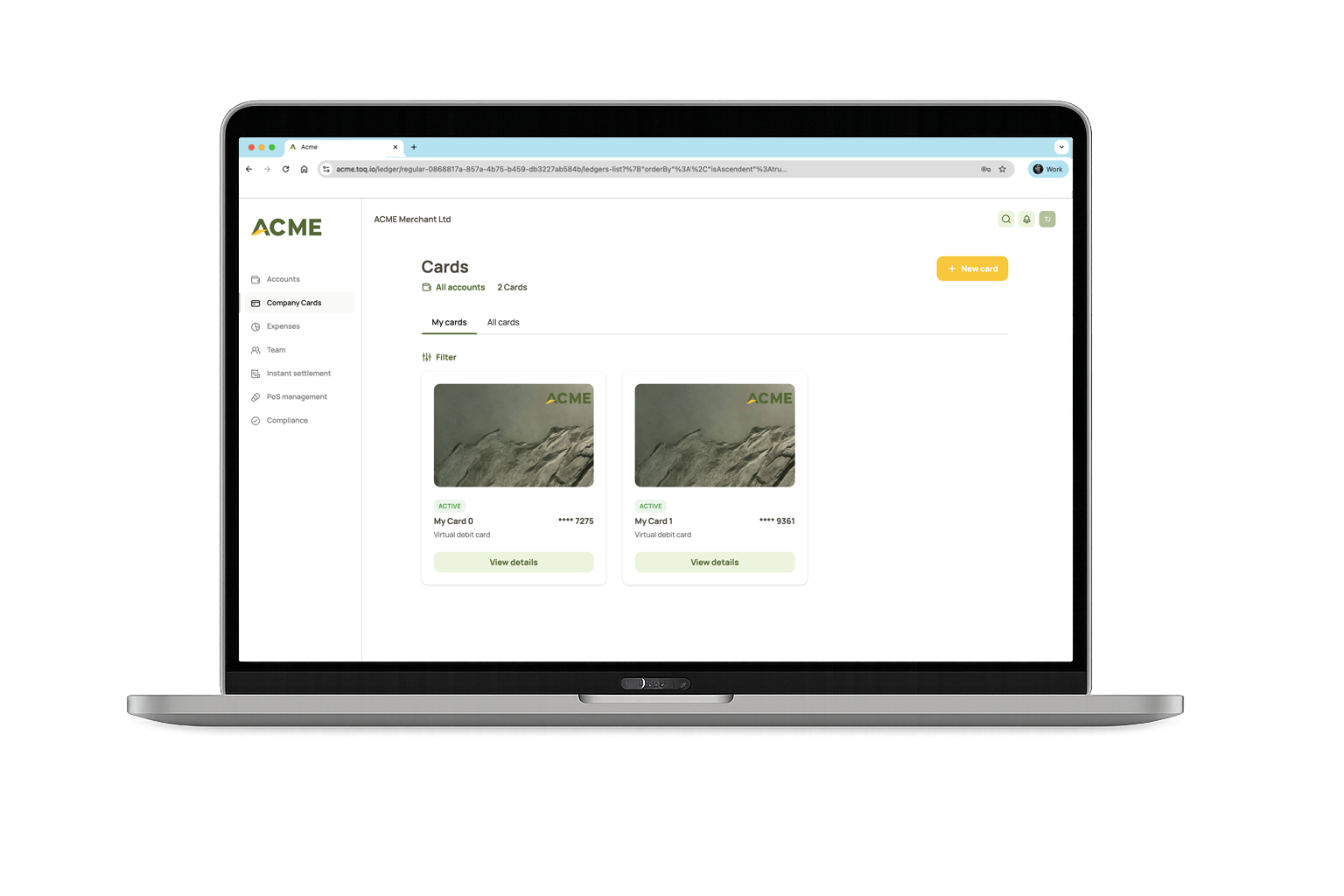

TDS can bring your product to life in no time. Install products from our marketplace, or bring your own, then customize them into a fully branded proposition. Build a proof of concept without writing a single line of code and launch your offering to market faster.

TEST & ITERATE

From Concept to Market Fit

Once your proof of concept is live, our platform and teams help you test, refine, and iterate. We work with you to validate the solution with real customers, adjust where needed, and overcome key challenges ensuring it’s ready to scale.

SCALE

Enterprise-Ready

When the proposition is validated, you can scale with confidence. Our modular infrastructure supports multiple user segments, customer types, and verticals so your solution can evolve into a fully expandable, enterprise-grade platform.

Your key benefits with Toqio as your partner.

Revenue without selling more product

Create new revenue streams with tailored financial solutions to monetize services, not just sales.

Turn inefficiency into margin

Enjoy fewer errors and delays, and have more time to focus on business growth.

Ease liquidity pressure for everyone

Deliver faster cash cycles, reduce churn, and foster more stable relationships.

Idea to launch in just a few weeks

Deploy solutions quickly without reinventing the wheel or making heavy infrastructure changes.

Once you've started, grow at your own pace

Use pre-built and pre-configured components to scale your platform efficiently.

Use real-time data to make better decisions

Obtain live insights into cash flow, credit risk, and operational performance throughout your network.

Real solutions for real growth.

Discover how companies and financial institutions can use Toqio to create impactful embedded finance solutions that drive growth and enhance customer experiences. Explore Toqio's potential to keep your organization competitive.

Innovation has brought us success (and a few awards)!

2025 April

"Most Influential Financial Technology Firms of 2025"

Harrington Starr

2025 March

"Disruptor of the Year"

UK Fintech Awards 2025 (Finalist)

2024 November

“Best Embedded Finance System”

Banking Technology Awards

2024 November

“Best Service to Business” and "Best Processing Programme/Proposition"

Cards and Payments Award 2025

(Finalist)

2024 October

“Best Embedded Finance Initiative” with Railsr

Banking Technology Awards

(Finalist)

2024 July

“Best Embedded Finance Project”

Pay360 Awards

(Finalist)

2023 October

“Oracle NetSuite Rising Star”

Deloitte UK Technology

Fast 50 award

2023 March

Rank #23

Startups 100 List

2022 September

“Best B2B/B2C Banking Initiative”

PAY360 Awards

2021 November

“Top Fintech Startup”

South Summit Awards

2020 August

“Third place” for Top Fintechs

Premios Expansión Startups

2020 April

“Top Spanish Fintech”

Expansión Startup Awards

2020 February

“Edition Winner”

Cuatrecasas Acelera Programa IV

2025 March

“Edition Winner” of the Cuatrecasas Acelera Programa IV

Let’s build the future of finance, together

Discover how your next big financial solution can become a reality. Whether you’re shaping a game-changing proposition or scaling a proven idea, Toqio gives you the strategy, technology, and speed to make it happen and make it matter.